Project Overview

The Quiulacocha Tailings Reprocessing Project is a transformative initiative by Cerro de Pasco Resources (CDPR), designed to recover valuable metals, drive economic growth, and support environmental restoration. By reprocessing one of the world's largest above-ground metal resources, the project promotes environmental remediation, social benefits, and circular economy opportunities.

CDPR holds a 100% interest in the El Metalurgista mining concession (95.74 ha), which includes 57 ha of the Quiulacocha Tailings Storage Facility (TSF). The project is located approximately 175 km north-northeast of Lima, in the Pasco region of Peru.

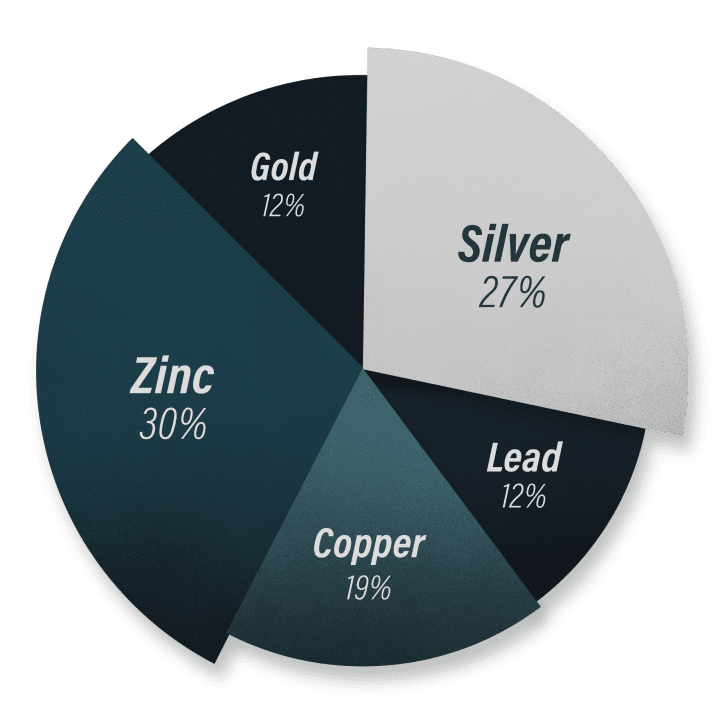

The project benefits from established infrastructure, including road access, a power grid, and abundant water supply, and is adjacent to an operational processing facility. The Quiulacocha TSF contains tailings from the Cerro de Pasco Mine, a world-class Cordilleran polymetallic deposit rich in silver, zinc, copper, lead, and gold.

Peru has traditionally been a significant player in the global mining industry, ranking as the world's second-largest producer of copper, silver, and zinc, and the second largest producer of gold in Latin America.

-

423 Moz AgEq*

Historic Estimate

-

Ga

A Strategic Metal

-

Ag, Cu, Zn

Significant Quantities

-

5.5 oz/t Ag Eq

Average Grade in the Polymetallic tailings

Historic Estimate

| Mining Period | Tonnes (000) |

Cu | Pb | Zn | Ag | Au |

|---|---|---|---|---|---|---|

| Copper Era (1906-1965) | 16,369 | 1.6% | - | - | 80 g/t | 1.2 g/t |

| Polymetallic Era (1952-1992) | 58,299 | - | 1.3% | 2.2% | 39 g/t | - |

| Mining Period | Cu | Pb | Zn | Ag | Au | AgEq |

|---|---|---|---|---|---|---|

| Copper Era (1906-1965) | 262kt | - | - | 42Moz | 632koz | 173Moz |

| Polymetallic Era (1952-1992) | - | 770kt | 1253kt | 73Moz | - | 250Moz |

| Total | 423Moz 1,2 |

Notes

1) Metal prices: Cu: $9000/t, Pb: $2000/t, Zn: $3000/t, Ag: $30/oz, Au: $2500/oz

2) Not 43-101 compliant. The tables are based on historical metallurgical balances and records. The purpose is to provide an indication of the resource expected to be encountered in the tailings to gauge project potential.

Quiulacocha Tailings

- NO MINING REQUIRED

Tailings extraction avoids drilling, blasting, and hauling, cutting around 40% of typical mining costs.

With no need for traditional mining, the process is more efficient, lowering expenses and reducing environmental impact by minimizing land disturbance and energy use.

- PYRITE POTENTIAL

Pyrite (indicatively 50% of the tailings) may represent a valuable by-product for the project.

The ongoing metallurgical test work program will also evaluate the potential for pyrite recovery, including estimated grade, by-products, and impurities.

- EXTENDED MINE LIFE

The discovery of gallium in high concentrations at the Quiulacocha TSF enhances the project's strategic importance, adding to its diverse metal content.

As a critical metal for high-tech industries, gallium strengthens the site's economic potential.

- EFFICIENT EXTRACTION

The project is anticipated to employ low-impact tailings extraction technologies. This approach has the potential to significantly reduce operational costs by avoiding traditional and energy-intensive mining processes such as drilling, blasting, and the extensive hauling of newly mined ore.

Recent Drilling

Cerro de Pasco Resources recently completed extensive drilling at the Quiulacocha Tailings Project, confirming high-grade silver, zinc, lead, and gallium, along with copper, gold, and pyrite potential. Results highlight strong metal continuity, reinforcing the project’s potential economic value.

Multiple drill holes returned 50+ g/t Ag, 1.5% Zn, and 1% Pb, with notable intersections up to 37m @ 57 g/t Ag.

Recent assays revealed gallium levels ranging from 35 grams per tonne (g/t) to as high as 141 g/t in certain sections. Notably, the southern section of the drilled area exhibited gallium grades between 50 to 110 g/t, nearly double the northern averages.

Estimated at 50% of tailings, with future metallurgical tests planned for recovery assessment.

-

Gallium

Gallium is essential for semiconductors, 5G, LED lighting, and solar panels. Its strategic role extends to military, aerospace, and green technologies. However, with China dominating production, supply chain security is a concern.

-

Pyrite

Pyrite is vital for sulfuric acid production, gold recovery, and industrial uses like catalysts and batteries. It’s an economic byproduct in mining and a key indicator mineral. While it can cause acid mine drainage, proper management turns it into a valuable mineral.

Significant Intercepts

| Hole ID | Length (m) | Silver (g/t) | Zinc (%) | Lead (%) | Copper (%) | Gold (g/t) | Gallium (g/t) | Indium (g/t) | AgEq* (oz/t) |

|---|---|---|---|---|---|---|---|---|---|

| SPT03A | 16 | 58.66 | 1.85 | 0.74 | 0.05 | 0.04 | 21.31 | 16.96 | 5.1 |

| SPT04 | 19 | 59.47 | 1.80 | 0.77 | 0.07 | 0.07 | 30.58 | 18.35 | 5.4 |

| SPT05 | 20 | 59.32 | 1.60 | 0.76 | 0.08 | 0.09 | 25.13 | 17.21 | 5.2 |

| SPT06 | 21 | 54.16 | 1.48 | 0.75 | 0.08 | 0.10 | 29.58 | 17.32 | 5.0 |

| SPT07 | 24 | 48.42 | 1.45 | 0.67 | 0.08 | 0.08 | 30.30 | 19.12 | 4.7 |

| SPT08 | 33 | 48.47 | 1.73 | 0.66 | 0.13 | 0.38 | 32.54 | 20.36 | 6.0 |

| SPT09 | 37 | 56.72 | 1.53 | 0.73 | 0.15 | 0.30 | 38.11 | 19.88 | 6.0 |

| SPT1_1 | 26 | 51.89 | 1.54 | 1.17 | 0.10 | 0.05 | 83.67 | 11.24 | 6.1 |

| SPT1_2 | 16 | 47.86 | 1.39 | 0.99 | 0.08 | 0.05 | 64.85 | 14.56 | 5.3 |

| SPT1_3 | 32 | 52.43 | 1.18 | 1.07 | 0.10 | 0.05 | 88.30 | 25.21 | 5.9 |

| SPT1_4 | 25 | 53.29 | 1.46 | 1.22 | 0.10 | 0.05 | 91.69 | 15.40 | 6.3 |

| SPT1_5 | 25 | 54.06 | 1.65 | 1.23 | 0.10 | 0.06 | 79.81 | 15.32 | 6.3 |

| SPT1_6 | 17 | 54.13 | 1.49 | 0.95 | 0.07 | 0.05 | 59.85 | 16.74 | 5.5 |

| SPT10 | 31 | 47.10 | 1.30 | 0.87 | 0.10 | 0.13 | 57.85 | 18.25 | 5.3 |

| SPT11 | 27 | 42.65 | 1.22 | 0.84 | 0.09 | 0.07 | 64.36 | 18.91 | 5.0 |

| SPT12 | 27 | 51.55 | 1.28 | 1.30 | 0.11 | 0.07 | 110.07 | 27.56 | 6.7 |

| SPT15 | 19 | 73.09 | 2.10 | 0.90 | 0.12 | 0.12 | 27.30 | 21.86 | 6.5 |

| SPT16 | 19 | 55.44 | 1.64 | 0.70 | 0.08 | 0.09 | 26.21 | 19.08 | 5.1 |

| SPT17 | 21 | 54.71 | 1.50 | 0.70 | 0.08 | 0.09 | 31.05 | 18.20 | 5.0 |

| SPT18 | 22 | 50.27 | 1.31 | 0.65 | 0.08 | 0.09 | 39.63 | 17.38 | 4.8 |

| SPT19 | 28 | 52.58 | 2.03 | 0.95 | 0.09 | 0.11 | 45.75 | 24.66 | 6.0 |

| SPT20 | 32 | 51.80 | 1.49 | 0.86 | 0.11 | 0.16 | 44.04 | 22.46 | 5.6 |

| SPT21 | 27 | 44.52 | 1.28 | 0.81 | 0.09 | 0.08 | 58.70 | 20.42 | 5.0 |

| SPT22 | 26 | 46.01 | 1.26 | 0.98 | 0.09 | 0.05 | 68.61 | 22.59 | 5.3 |

| SPT23 | 28 | 53.12 | 1.53 | 1.11 | 0.13 | 0.10 | 83.14 | 15.99 | 6.4 |

| SPT25 | 15 | 54.74 | 1.73 | 0.74 | 0.05 | 0.05 | 29.79 | 18.59 | 5.0 |

| SPT26 | 14 | 60.54 | 1.59 | 0.86 | 0.05 | 0.04 | 40.93 | 20.71 | 5.4 |

| SPT27 | 21 | 48.56 | 1.47 | 0.68 | 0.08 | 0.10 | 34.80 | 19.52 | 4.9 |

| SPT28 | 25 | 47.56 | 1.47 | 0.72 | 0.09 | 0.12 | 40.67 | 18.14 | 5.0 |

| SPT29 | 22 | 47.72 | 1.29 | 0.79 | 0.10 | 0.11 | 46.02 | 23.42 | 5.0 |

| SPT30 | 25 | 45.95 | 1.27 | 0.80 | 0.10 | 0.08 | 48.17 | 23.92 | 5.0 |

| SPT31 | 23 | 47.03 | 1.30 | 0.95 | 0.07 | 0.05 | 61.57 | 19.20 | 5.2 |

| SPT32 | 31 | 46.87 | 1.26 | 0.96 | 0.09 | 0.05 | 64.78 | 26.16 | 5.3 |

| SPT34 | 15 | 58.77 | 1.79 | 0.70 | 0.04 | 0.04 | 31.29 | 18.97 | 5.2 |

| SPT35 | 19 | 55.24 | 1.62 | 0.68 | 0.06 | 0.06 | 40.38 | 20.64 | 5.2 |

| SPT36 | 21 | 49.46 | 1.30 | 0.64 | 0.07 | 0.07 | 32.42 | 17.64 | 4.5 |

| SPT37 | 18 | 50.51 | 1.28 | 0.89 | 0.07 | 0.05 | 49.26 | 20.89 | 5.0 |

| SPT38 | 18 | 50.38 | 1.48 | 0.96 | 0.06 | 0.05 | 55.68 | 19.52 | 5.3 |

| SPT39 | 22 | 46.79 | 1.63 | 0.86 | 0.09 | 0.08 | 50.20 | 17.76 | 5.3 |

| SPT40 | 20 | 54.61 | 1.63 | 1.35 | 0.12 | 0.09 | 96.57 | 25.15 | 7.0 |

| Total | 927 | 51.65 | 1.49 | 0.88 | 0.09 | 0.10 | 53.16 | 19.85 | 5.5 |

*Prices used: Silver: $30/oz, Zinc: $3,000/tn, Lead: $2,000/tn, Copper: $9,000/tn, Gold: $2,500/oz, Gallium: $550/kg, Indium $350/kg.

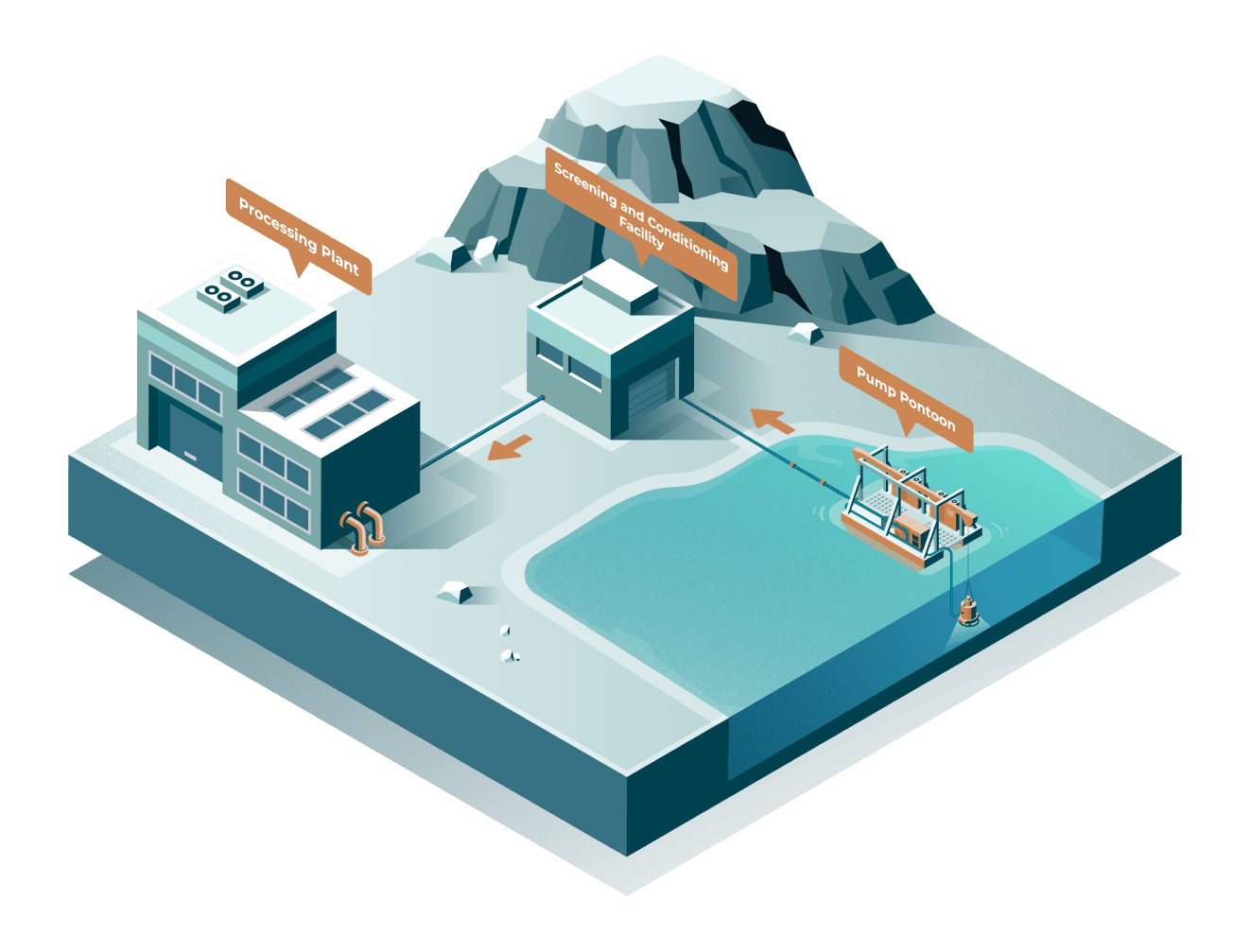

Moving Tailings

How Submersible Pumps on Barges Extract Tailings Pump Setup: A submersible slurry pump is mounted under a floating barge and fully submerged in the tailings.

The pump agitates and sucks up slurry (water + solids), pushing it through a floating pipeline to the processing facilities.

Supplied via connected electrical cables.

Accesses unstable or remote tailings areas. Flexible and mobile. Reduces energy and infrastructure costs. Environmentally friendly.